The market size value in 2025 was

USD $21.23 billion

Revenue forecast in 2032 is estimated to be USD $32.34 billion

The compound annual growth rate from 2025 to 2032 is estimated to be 6.2%

Titanium Dioxide is a naturally occurring oxide of titanium. It has the highest refractive index of any material known to man and is one of the whitest materials on earth.

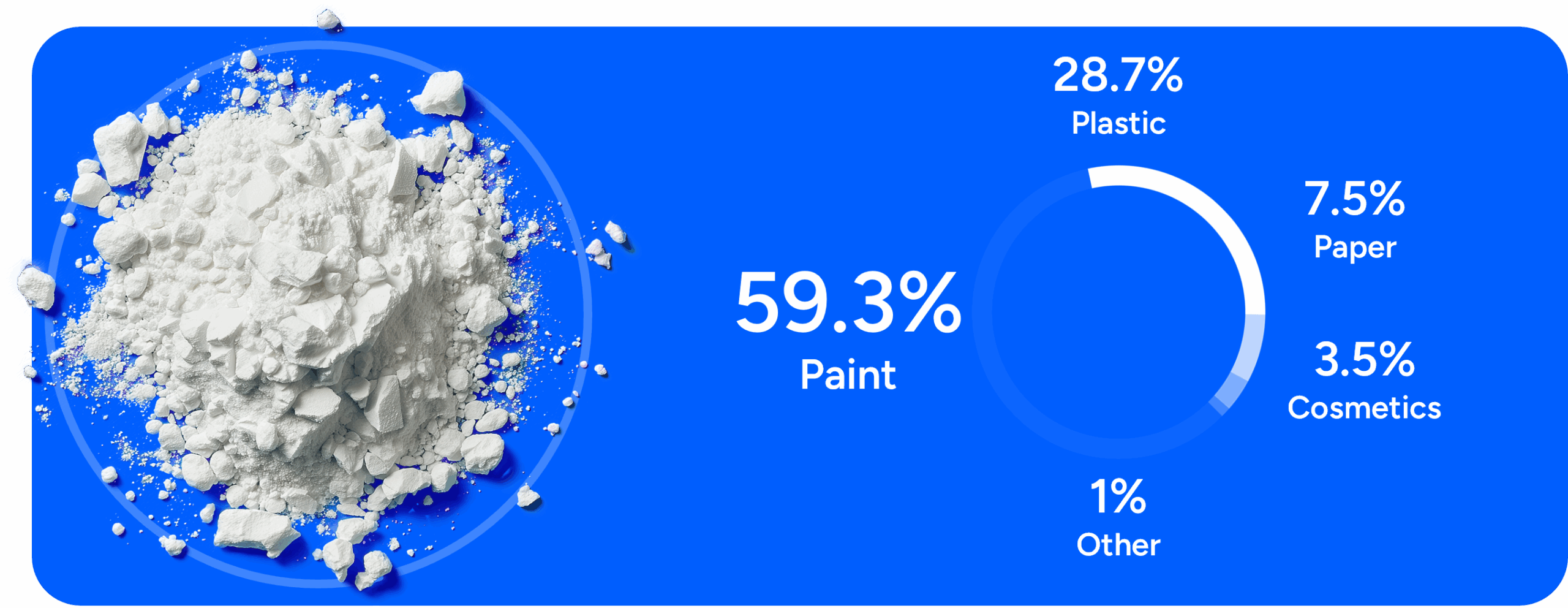

When ground into a fine powder, it transforms into a pigment that provides maximum whiteness and opacity.

TiO₂ pigments are used in paints and coatings, plastics, paper, building materials, cosmetics, pharmaceuticals, foods and many other commercial products.

High temperature (1,300°C), highly corrosive chlorination, reduction and distillation process to form titanium metal sponge

High temperature, low yielding, forging processes to form semi-finished titanium products (plates, sheets, bar, wire, etc.)

The ingot to final titanium metal part supply chain has less than 10-20% yield

High temperature (1 ,850°C) multi-vacuum melting processes to form ingots

Very low yield manufacturing process to produce final titanium parts

High-energy, high-carbon, and unsustainable titanium supply chain

Titanium alloys have a far higher strength-to-weight ratio than aluminum and magnesium alloys

Titanium alloys can be 3-5x stronger than stainless steel

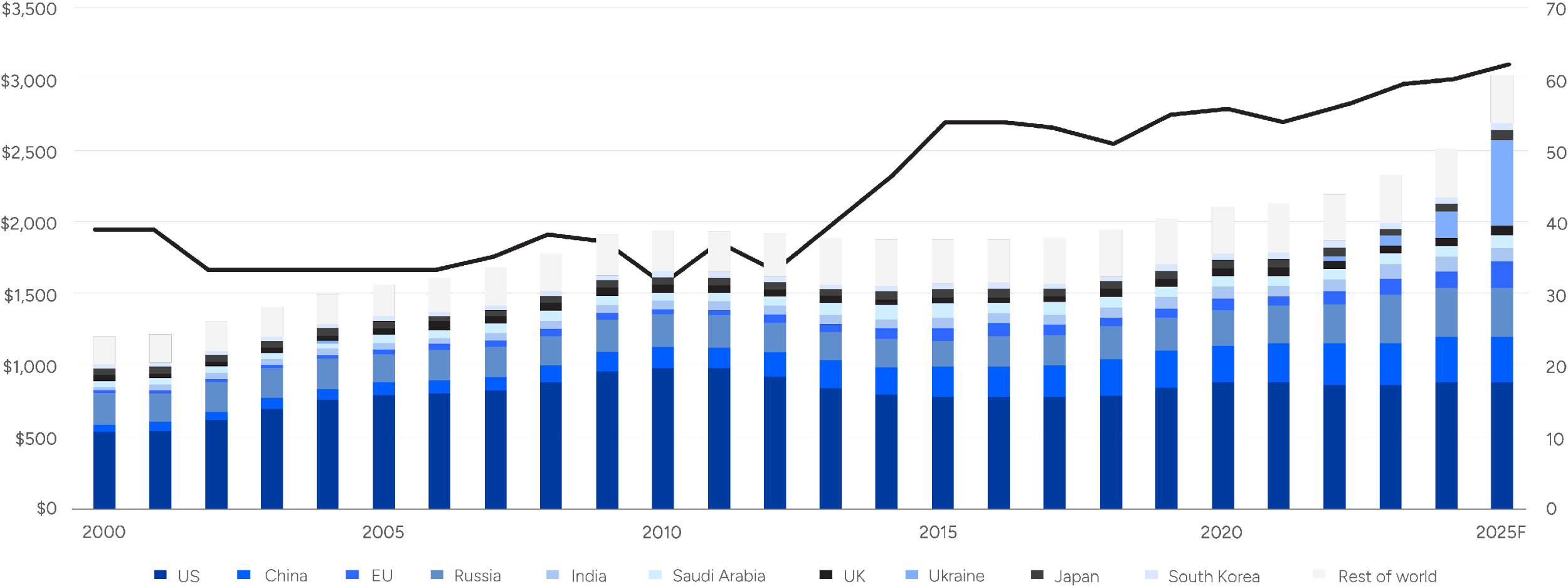

Military spending (US$ billions; left axis); active wars (count; right axis)

Note: Historical data through 2023 is an aggregate of the underlying data. Forecast data for 2024 and 2025 is based on the continuation of trends based on a three-year rolling average.

Sources: Stockholm International Peace Research Institute (SIPRI); UCDP/PRIO Armed Conflict Dataset version 24.1; EY analysis.

Global Titanium for Military Market Research Report (Sept 15, 2024) https://www.wiseguyreports.com/reports/titanium-for-military-market

Global defense spending hit US$2.46 trillion in 2024 — growing by 7.4% annually. It is expected to increase further in 2025 as geopolitical tensions continue to rise and NATO member nations increase defense spending as a % of GDP towards 5%.

The dedicated “Titanium for Military” market is estimated at US$9.57 billion in 2024.

As demand for titanium metal surges, so too has the US and EU’s exposure to supply vulnerabilities.

In the US, there is only one titanium sponge producer, a facility in Utah with an estimated production capacity of 500 tons per year. In the EU, the region does not produce titanium sponge at all and is 100% reliant on imports.

China’s increasing implementation of export restrictions across a range of critical minerals, from tungsten to antimony, has raised alarms about potential future restrictions on titanium. Russia has similarly voiced its concerns about exporting titanium.

The EU has no domestic production capacity of titanium sponge and is therefore a net importer of titanium metal, with an import-to-export ratio of 10:1. In particular, supply from high-quality TiO2 deposits in Ukraine have been disrupted due to the war.

The size of the global titanium dioxide market was valued at approximately $18.82 billion in 2022. It is projected to grow to around $19.798 billion in 2023.

The global titanium dioxide market is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 through 2030, with expectations to reach a market value of approximately $30.62 billion by the end of 2030.

The Asia Pacific region held the dominant position in the titanium dioxide market, securing the largest revenue share at 42.4% in 2022. This significant market share is largely due to the surge in construction activities across countries like India, China, and other Southeast Asian nations. This increase in construction has driven the demand for paints and coatings in the region, thereby bolstering the growth in demand for titanium dioxide products.

The major participants in the titanium dioxide market comprise notable companies such as The Chemours Company, Tronox Holdings PLC, LB Group, Venator, and Kronos Worldwide, Inc.

The growth of the titanium dioxide (TiO2) market is primarily fueled by the rising demand for lightweight vehicles, driven by stringent emission regulations, and the expanding use of TiO2 in applications such as printing inks, rubber, and chemical fibers.